Dowanload App Candlestick patterns are a visual representation of price movements in financial markets, commonly used in technical analysis to analyze and predict future price movements. These patterns derive their name from the shape of the individual elements, which resemble candlesticks. Each candlestick typically represents the price movement of an asset over a specific time period, such as minutes, hours, days, or weeks.

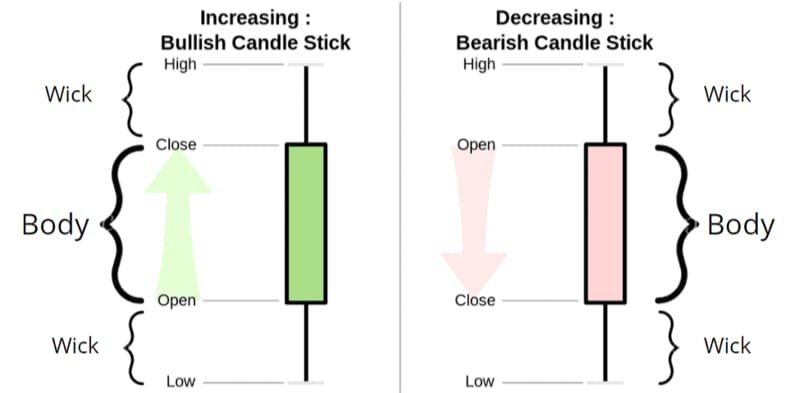

A standard candlestick consists of four main components:

- Open: The opening price of the asset during the specified time period.

- Close: The closing price of the asset during the specified time period.

- High: The highest price reached by the asset during the specified time period.

- Low: The lowest price reached by the asset during the specified time period.

The body of the candlestick is formed by the open and close prices, and the wicks (or shadows) represent the high and low prices. Candlestick patterns are formed by the arrangement of one or more candlesticks, and analysts use them to identify potential trend reversals, trend continuations, or market indecision.

Common candlestick patterns include:

- Doji: A candlestick with an open and close that are virtually equal, indicating market indecision.

A doji (dо̄ji) is a name for a trading session in which a security has open and close levels that are virtually equal, as represented by a candle shape on a chart. Based on this shape, technical analysts attempt to make assumptions about price behavior.

- Hammer: A single candlestick pattern with a small body and a long lower wick, signaling a potential reversal after a downtrend.

Hammer candlesticks typically occur after a price decline. They have a small real body and a long lower shadow. The hammer candlestick occurs when sellers enter the market during a price decline. By the time of market close, buyers absorb selling pressure and push the market price near the opening price. - Engulfing Pattern: A reversal pattern where a small candle is followed by a larger candle that completely engulfs the previous one.

Engulfing candlestick patterns are comprised of two bars on a price chart. They are used to indicate a market reversal. The second candlestick will be much larger than the first, so that it completely covers or ‘engulfs’ the length of the previous bar. - Hanging Man: Similar to the hammer but occurs after an uptrend, suggesting a potential reversal to the downside.

A hanging man is a bearish reversal candlestick pattern that occurs after a price advance. The advance can be small or large, but should be composed of at least a few price bars moving higher overall. The candle must have a small real body and a long lower shadow that is at least twice the size as the real body.

5.Morning Star: A bullish reversal pattern formed by three candlesticks: a long bearish candle, a small bullish or bearish candle, and a long bullish candle.

A morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. A morning star forms following a downward trend and it indicates the start of an upward climb. It is a sign of a reversal in the previous price trend.

DowanloadApp Angleone

6.Evening Star: The bearish counterpart of the morning star, signaling a potential reversal to the downside.

It’s a bearish candlestick pattern that consists of three candles: a large white candlestick, a small-bodied candle, and a red candle. Evening star patterns are associated with the top of a price uptrend, signifying that the uptrend is nearing its

It’s important to note that while candlestick patterns can be useful tools in technical analysis, they should not be used in isolation, and other indicators and analysis techniques should be considered for a comprehensive view of market conditions. Additionally, the interpretation of candlestick patterns may vary, and traders often use them in conjunction with other technical analysis methods.